The growth of online retail changed how consumers are spending their money. As a result, people are progressively shifting their financial and buying habits to fit a digital and mobile lifestyle.

According to stats, the transactional value of mobile payments is projected to cross $12,407.5 billion by the end of 2025. Further projections show that the ecommerce market will grow to $6.4 trillion by 2024.

With the landscape changing rapidly, businesses worldwide are structuring payment policies and transforming their operations and finances to include digital payments. This article aims to shed light on the rise of digital payments and the role of chatbots in making digital transformation an efficient and successful process.

The Shift to Online Payments

The rapid advancement of technology enables digital transformation in all aspects of our lives, including our finances. We are constantly being introduced to new technologies that facilitate online transactions, such as contactless cards, mobile payments, online banking and smartwatches. Even government initiatives worldwide support the growth of digital payments and the shift towards a cashless economy and society.

In 2021, digital buyers reached 2.4 billion, representing 27.6% of the global population. The progressive growth reflects people’s new online buying behaviour, seeking a seamless and convenient experience. Today, consumers are prioritising the many advantages offered by digital payments, such as:

No geographical boundaries: With the introduction of digital payments, consumers can now buy from anywhere in the world. Digital wallets, such as PayPal, and online banking services, such as Revolut and N26, can accept payments in different currencies without the bureaucracy and cost of currency exchange.

Convenience and Flexibility: People can choose and buy anything they want within minutes. Unlike offline transactions, eCommerce is available 24/7, and consumers can choose the more convenient time to purchase their goods and services. You don’t have to worry about queues or opening hours.

Security and Protection: Digital payments adds a layer of security and protection that offline payment cannot offer. With encryption and anti-fraud measures, people can complete online transactions without the possibility of fraudulent actions.

Paying with Chatbots

Chatbots are transforming business and customer interactions in all aspects, including payments. Bots are designed to streamline the customer journey from start to finish: from the first moment you reach out to a company to the moment you finish a payment transaction.

Customers nowadays go for online purchases because they prioritise experience and convenience, where chatbots excel. Here are four ways how adding chatbots to your business strategy will transform your digital payment system:

Top-Notch Customer Service and Engagement: Chatbots are available for customers 24/7, so they can quickly provide accurate and consistent information to customers related to billing and payments. Bots can also easily track customers’ data and provide a more personalised payment experience, increasing customer satisfaction rates.

Opportunities to Sell More: With the power of analytics, businesses can integrate their sales and marketing strategies when building their chatbot. Your chatbot can identify cross-sell and up-sell opportunities and duplicate opportunities for sale.

Fast Answers and Feedback: Due to their availability and intelligence, bots can answer queries almost instantly. Some advanced features even allow bots to identify customers’ emotions and tone, so they can quickly transfer any queries, feedback or complaints to a human agent.

Managing Payments with Flow XO

Flow XO for Chat is capable of taking and receiving payments through a conversation. Users can rapidly and efficiently manage their payments via Chatbot.

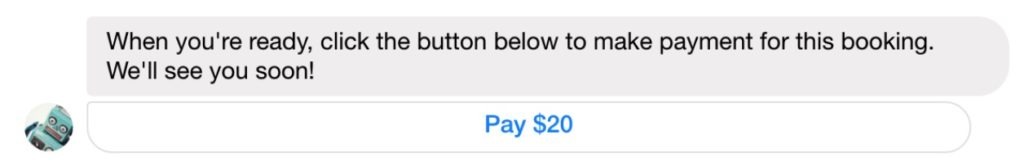

If a customer wishes to make a payment via Flow XO, the bot can identify a particular product or service for purchase and simply request a payment. The bot will specify the currency and the amount to be paid and a link is automatically created that will take the customer to a secure payment portal to complete the transaction. When your payment is processed, an action is triggered and you can handle the payment in another flow, by sending a confirmation email, a welcome pack or whatever you choose.

In Flow XO, payments are processed using the Stripe payment engine, so you don’t have to manage any credit card information and it guarantees a fully PCI-compliant system.

How Flow XO Payments Work

Before setting up payments with Flow XO, you need to sign up and activate your Stripe account. You will simply fill out a form with basic information about your product and your business.

To handle payments with Flow XO, you usually need to set up 2 different flows:

Request Payment trigger

You can use the ‘Request a Payment’ where you have a single item to sell, or where you want to request a payment for something. For example, you may have a flow where you ask some questions and then collect a booking fee to complete an application, or even ask for a donation if you’re a charity.

If you want to add a ‘Request a Payment’ action to a flow, find the point in the flow where you want to request a payment, and click the ‘+’ button to add an action. You’ll see ‘Request a Payment’ in the list of popular actions under the ‘Payments’ header. Flow XO has a wide variety of Action options available for you to use.

Receive Payment trigger

When you receive a payment via Flow XO chatbot, you can trigger an action in your flow; either to thank the user for the payment, to enter the details of the payment to a spreadsheet or even just to send yourself an email.

The Receive Payment trigger works every time a payment is made through either ‘Request a Payment’ or ‘Sell a Product’. The outputs usually fall into these categories:

Conclusion

The majority of operations we know today have been impacted by digital transformation, including the payment segment. In this context, chatbots enter the scene to revolutionise payment systems as we know them today. Today, customers look for efficiency, ease of usage, satisfaction and experience, and chatbots can provide all that.

Implementing a chatbot software such as Flow XO guarantees you a secure and reliable system that delivers an excellent payment experience from start to finish. Reap the benefits of digital payments by signing up to Flow XO for free!